Ways to Give

However Woodstock has touched your life, whether you are an alumnus, parent or friend, we offer a range of ways to give back to suit everyone. For more information about ways to give and how you can support Woodstock School, please check out our FAQs or contact the Alumni and Development Office at advancement@woodstock.ac.in.

Woodstock School is a nonprofit educational institution registered and certified under section 80G of the Indian Government Income Tax Act.

Donation Transactions for Woodstock School (Tax benefit for Indian citizens; see below for where to give for tax benefit in the U.S. Canada, and the UK).

Online Giving to Woodstock via Secure Website - Indian Citizens Only

Our Giving Pages provide a simple and secure way to choose a project you would like to support and donate to Woodstock School. Visit our primary Giving Page or our Current Campaign Page, select the cause you would like to support and choose the amount you would like to donate. You will be automatically transferred to make a secure payment via Razorpay.

Giving to Woodstock via Bank transfer

Indian Passport Holders and Entities Registered in India

Please use the following information for a bank-to-bank transfer:

Bank Name: AXIS Bank Ltd

Account Name: Woodstock School

Account No: 435010100009799

IFSC Code: UTIB0000435

Bank Address: Garhwal Terrace, The Mall, Mussoorie – 248179, Uttarakhand, India.

Type: Savings Account

Non‐Indian Passport Holders (Including OCI/PIO card holders) and Entities Registered outside India

Donations from Non‐Indian Passport Holders (including PIO/OCI card holders) or Entities Registered outside India need to be remitted to Woodstock School’s FCRA account detailed below. NOTE: The account name for the transfer must be EXACTLY as it appears here.

Bank Name: State Bank of India

Account Name: The Board of Directors of the Woodstock School and Teachers Training College

Account Number: 40078561071

IFS Code: SBIN0000691

SWIFT Code: SBININBB104

Bank Address: FCRA Cell, 4th Floor, State Bank of India, New Delhi Main Branch, 11 Sansad Marg, New Delhi ‐ 110001

If you need assistance in making a bank transfer, please contact advancement@woodstock.ac.in.

Giving to Woodstock via Check

PLEASE READ FULLY AS DIRECTIONS DIFFER BASED ON THE DONOR’S COUNTRY OF CITIZENSHIP

ALSO NOTE THAT, IN SOME CASES, CHECK PROCESSING TIMES MAY RANGE FROM WEEKS TO MONTHS

Indian Passport Holders and Entities Registered in India

You may write a check payable to Woodstock School and mail it to:

Advancement Office

Woodstock School

Landour, Tehri Road

Mussoorie 248179

Uttarakhand, India

Non‐Indian Passport Holders (Including OCI/PIO card holders) and Entities Registered outside India

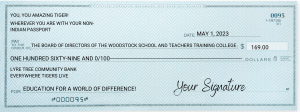

Donations from Non‐Indian Passport Holders (including PIO/OCI card holders) or Entities Registered outside India need to be remitted to Woodstock School’s FCRA account. NOTE: The payee written on the check must be EXACTLY as it appears here.

Above: Example of a properly filled check

You may write a check payable to The Board of Directors of the Woodstock School and Teachers Training College and mail it to:

Advancement Office

Woodstock School

Landour, Tehri Road

Mussoorie 248179

Uttarakhand, India

If you need assistance, please contact advancement@woodstock.ac.in.

Phone or mail

By phone: Indian passport holders can call the Advancement office at +91 (0135) 661-5163 or 661-5161 during business hours (8:30 AM to 4:30 PM, Monday through Friday India time) to make a credit card gift over the phone.

By email: You may email advancement@woodstock.ac.in for assistance making a donation.

Other Ways to Support Woodstock School

Supporting Organizations Offering Tax Benefit: Friends of Woodstock School (U.S.) – Canadian Friends of Woodstock School (Canada) – Woodstock School UK Charitable Trust (UK)

Friends of Woodstock School (FWS) is an independent 501(c)(3) organization based in the United States which includes Woodstock School among its grant beneficiaries. FWS is a good option for those in the U.S. seeking online payment or tax benefit for their donations. FWS is Woodstock School’s largest source of philanthropic funding. FWS prides itself in being an excellent steward of the donations they receive and through wise management of funds is able to offer $1.19 in funding to Woodstock for every $1.00 given in support of the school. Click here to visit the FWS website, learn more, and make a donation.

Canadian Friends of Woodstock School (CFWS) is an independent charitable organization based in Canada supporting Woodstock School. CFWS is a good option for those in Canada seeking online payment or tax benefit for their donations. Canadian Friends of Woodstock School was started to support Woodstock School and to help Woodstockers stay in touch with the Woodstock community in Canada. Click here to visit the CFWS website, learn more, and make a donation.

Woodstock School UK Charitable Trust is an independent charitable organization based in Canada supporting Woodstock School. Established on the occasion of Worldwide Woodstock Day 2023, details will be published soon. In the meantime, please write to advancement@woodstock.ac.in with any questions about tax deductible giving in the UK.

Inclusion of Woodstock in Estate and Other Financial Plans

Planned gifts, of any size, can have a significant impact on Woodstock School. Anyone who includes Woodstock School or Friends of Woodstock School Foundation in their financial plans becomes a member of the Lyre Tree Society and has their name included in commemorative signage on campus.

To date, nearly 100 supporters have become members of the Lyre Tree Society and we hope you will consider doing so as well.

Planned gifts allow you to support our students, programs, and campus far into the future while potentially also providing tax and other benefits to you and your family. If you wish to support Woodstock this way, we invite you to contact us to discuss a planned gift or to make a bequest to Woodstock School.

Alumni wishing to consider Woodstock School in their estate plans and require US tax credit can contact the Friends of Woodstock School (FWS) Foundation directly to explore planned giving options. Ways of benefiting Woodstock School through a planned gift to the FWS Foundation are detailed on the Friends of Woodstock School website.

See the sidebar for more details on the Lyre Tree Society or email development@woodstock.ac.in if you’ve made a bequest and would like to join the society.

Funds Matching Your Donation Offered by Corporations

Your employer could increase the impact of your generosity. Many companies worldwide offer matching gift programmes that allow employees to double or triple their contributions to non-profit or charitable organisations. Please check with your employer’s human resources department to see if they support employee matching funds. If so complete and sign any matching gift forms, and send them along with your annual fund gift made payable (to “Woodstock School”) to Woodstock School, Advancement Office, Woodstock School, Mussoorie, Uttarakhand 248179.

Grant Awards and Designations to Woodstock

You can designate Woodstock as a recipient of a grant from a family foundation, charitable gift, or donor-advised gift fund.

Woodstock School also appreciates being made aware of opportunities to apply for grant funding. Write to advancement@woodstock.ac.in to share any opportunities.

Corporate Social Responsibility Funding for Woodstock

Woodstock School is eligible to receive Corporate Social Responsibility funding from corporates in India and is registered with the Indian government as a CSR-eligible non-profit organization.

Woodstock School has received funds from corporates with ties to our community in support of capital projects and scholarships and we hope more corporates will join in supporting Education for a World of Difference.

For more details on CSR donations to Woodstock school, contact advancement@woodstock.ac.in

Volunteer at Woodstock

Woodstock offers many ways to get involved, volunteering on the school board, providing short-term assistance with specific projects or departmental work, speaking and working with students and faculty through the Centre for Imagination, and more. Contact the Advancement and Alumni Relations Office if you are interested in pursuing volunteer opportunities.

Tax Benefits for Your Donation

Depending upon your personal circumstances, you may be able to maximise your donation by claiming tax-relief.

Tax Benefit for Donations From Indian Citizens

Donations can be made directly to Woodstock School by Indian citizens via the online donation portal or other methods detailed above and are eligible for tax benefit under section 80G of the Income Tax Act. Anyone making a donation will receive an 80G certificate for tax filing purposes.

Tax Benefit for Donations From U.S. Citizens

Donations can be made to Friends of Woodstock School Foundation (FWS), an independent 501(c) (3) Non-Profit Organization. FWS supports the educational mission and purposes of Woodstock School and welcomes your donations. Your donations to FWS are tax-exempt in accordance with US law.

Tax Benefit for Donations from Canadian Citizens

Residents of Canada can donate through Canadian Friends of Woodstock School (CFWS), a registered charity separate from Friends of Woodstock School in the U.S.

Visit www.canadahelps.org to make an online donation. Put Canadian Friends of Woodstock School in the Find a Charity search cell.

Alternatively, donations may be mailed to:

R.C. Morris & Company

570 Granville St., Suite 810

Vancouver, BC

V6C 3P1 Canada

Attn: Canadian Friends of Woodstock School

Phone (R.C. Morris & Company): +1 604-639-8196

Tax Benefit for Donors Holding Citizenship Other than India, U.S., and Canada

Donors who are not eligible for tax relief in the US or India should check the regulations in the country in which they are residents to establish whether tax relief is available on their donation. Note that a UK charitable trust will soon be able to receive donations in support of Woodstock School while providing tax benefit for UK citizens.

Lyre Tree Society

Make Woodstock School’s future part of your legacy by including Woodstock School in your financial plans.

The Lyre Tree Society honors those who have made bequests to benefit Woodstock School or have otherwise included Woodstock School in their financial planning.

The Lyre Tree Society is named after the beloved tree, now gone, that overlooked the Doon Valley on the Woodstock School Campus. Membership is open to anyone who simply notifies Woodstock or Friends of Woodstock School (U.S.) that he or she had taken formal steps to support Woodstock directly or FWS through their estate or gift planning.

Your membership in the Lyre Tree Society will inspire your fellow alumni and friends to take steps to ensure Woodstock School ‘s ability to withstand the tests of time, offering Education for a World of Difference now and in the future.

To find out more or notify us of your bequest, please email advancement@woodstock.ac.in

The Chakkar

Report from the Advancement Office